digitalized code that identifies the

individual host and simplifies controls

on the activities and the territory by the

Public Administration and the Public

Security Authorities.

In order to obtain the above digitalized

code and carry out the SCIA statement,

from an operational point of view, it will

be mandatory to have a certified email

box and a digital signature kit that, for

example, you can buy on aruba.it and/or

on register.it.

With the same procedure, you can

also obtain a username and password to

access the website "Portale Alloggiati" of

the local police headquarters (Questura)

to which, as said earlier, hosts must

communicate the personal information

of their guests and pay the local tourist

taxes.

There are also specific requirements

concerning (i) total compliance with

the rules governing the consumption

the number of beds per square meter

(one bed for eight square meters for

properties up to 48 square meters and

so on), (iii) specific rules about the type

of household appliances that must equip

the apartments, and, of course, (iv) the

compliance of the buildings to the urban

planning and building rules.

of 2018 applies, which, in addition

to the filing of the SCIA for CAV (see

previous section), also has a mandatory

requirement for an identification code of

the single apartment and of the individual

host, similar to the one for Lombardy's

municipalities, but, in this case, such

code will be valid on a regional basis.

In this way, an "enlarged" database

has been created to facilitate and make

more effective the control activities, also

for public security.

provide for specific requirements about: (i)

town and building planning, (ii) hygienic-

sanitary matters, and (iii) safety of plants

(for electricity and gas in particular)

servicing the properties.

Failure to comply with these

provisions will be punished with fines of

up to

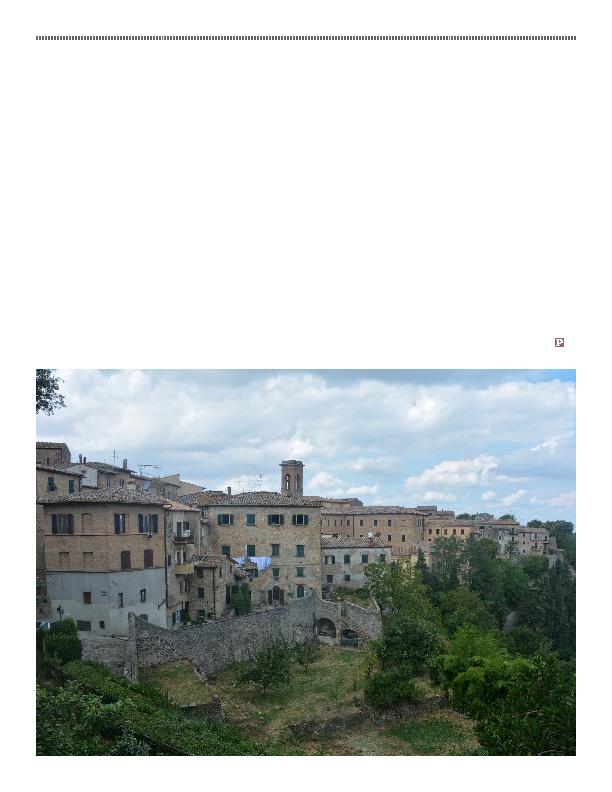

Tuscany, where Regional Law no. 42 of

2000 and Regional Regulation no. 18/R

of 2001 apply, as well as some specific

subsequent local rules, which require the

host to have a VAT number if they manage

real estate short-leases for more than 90

days a year, with the individual rental

periods not lasting more than seven days

in any case.

This is just a general and brief

picture... happy Airbnb, everybody!